Back to all solutions

Back to all solutions

Fraud prevention

We provide an integrated security platform to mitigate and defend against existing and emerging threats.

Our advanced user behavior analysis and machine learning capabilities help create strong profiles and trigger alerts that stop fraud in its tracks.

More approvals, less risks

Reduce risk through real-time triggering actions with biometric, user scoring, and workflow-based security.

Preserve your brand reputation and build trust among your customers.

Boost acceptance rates, avoid false positive results and execute automatic transaction approval.

Generate a stronger profile based on customer behavior analysis.

Implement a solid authentication process and block threats to your business.

Deliver immersive digital experiences with enhanced security.

Industry leaders in digital identity, AML, and fraud prevention power our solutions, with no extra work required from you.

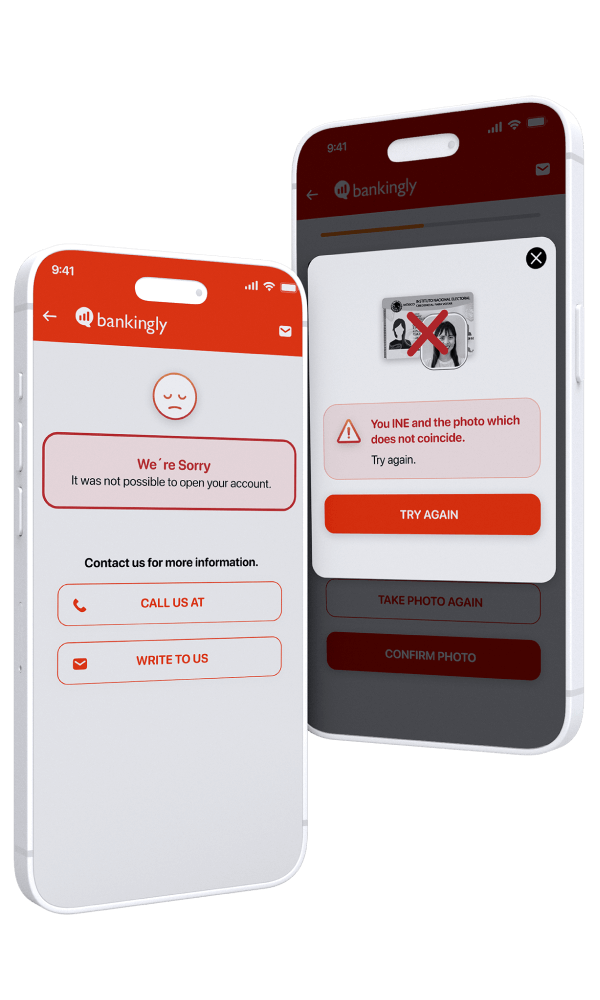

- Advanced user authentication with multi-factor methods, including facial recognition

- Stronger security through integration with government agencies for identity validation

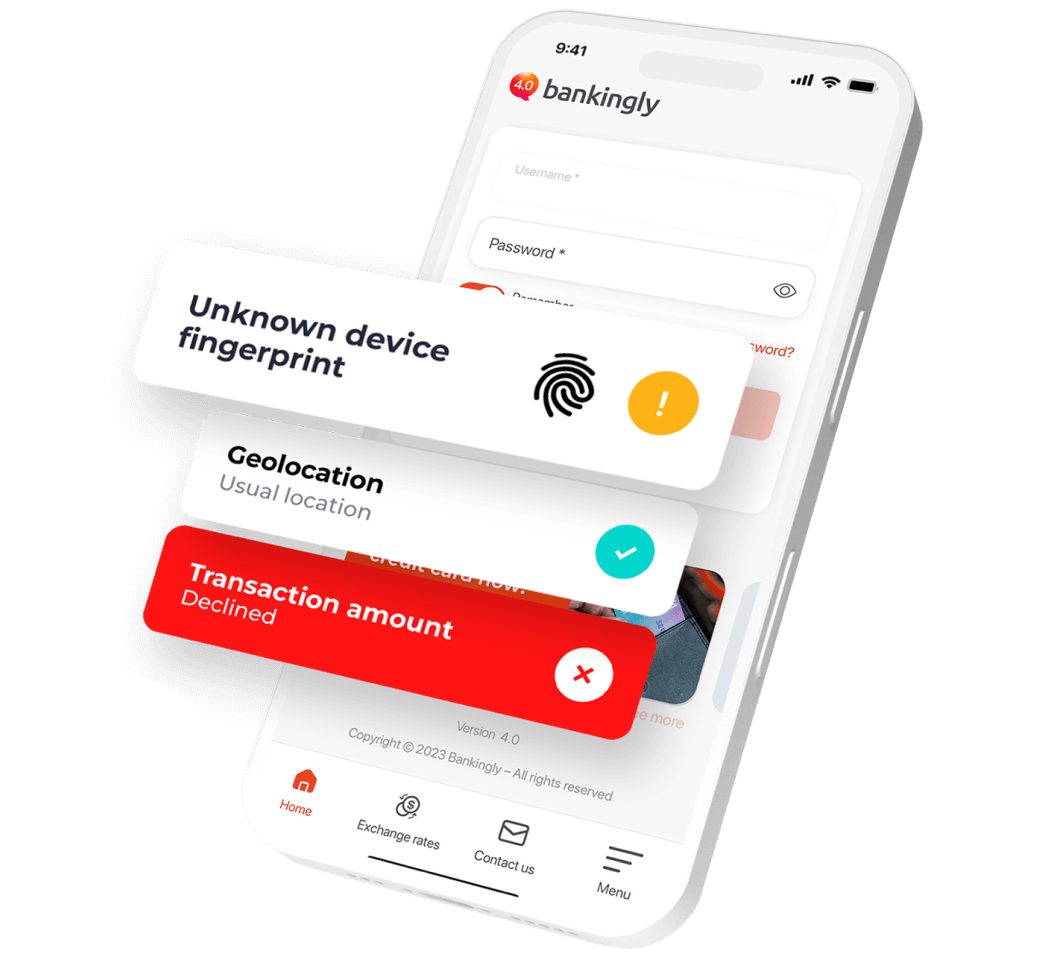

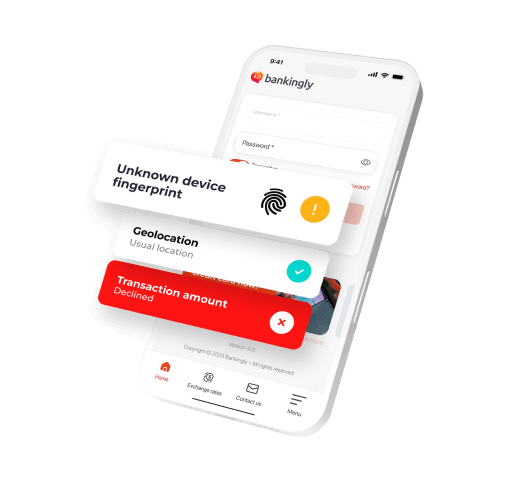

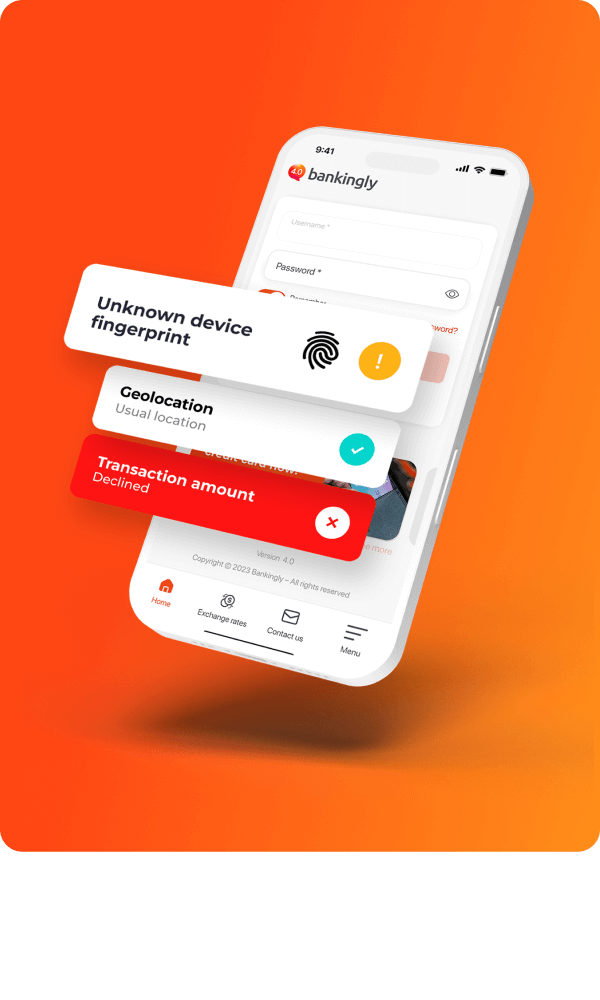

- Identification of devices through fingerprinting technology

- Customizable and streamlined integration through cloud-based platform, with flexibility and ease of use as top priorities.

User scoring

Improve user experience with customized scores generated by our advanced algorithm analyzing user behavior and details, empowering data-driven decision making.

Preserve your brand reputation and build trust among your customers.

Boost acceptance rates, avoid false positive results and execute automatic transaction approval.

Generate a stronger profile based on customer behavior analysis.

Implement a solid authentication process and block threats to your business.

Deliver immersive digital experiences with enhanced security.

-

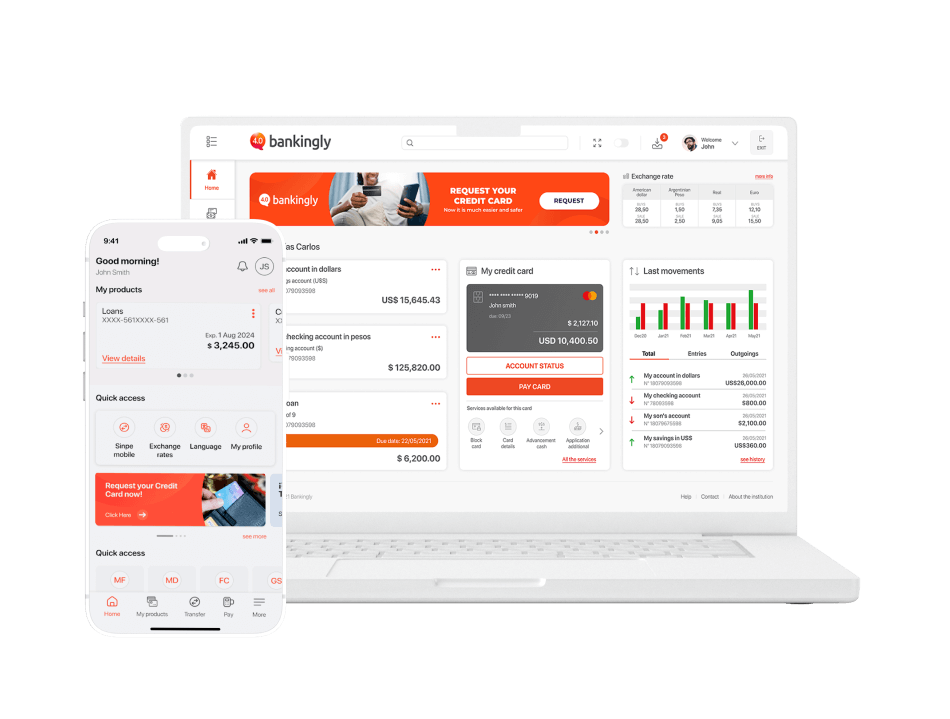

Mobile and Online Banking have been very well received by our partners, leaving us good feedback on the tools we have provided them to manage their accounts

Martín V. Chief Information Security Officer -

A great solution for our partners. We have received the necessary support and more from Bankingly, always maintaining full readiness to support us at any time. Excellent and very professional treatment

Joshue Fernando L. Operations Coordinator -

A great tool: practical, functional, and easy to use in all aspects, both for administration and for the general public

Francisco M. Systems Manager -

The experience is excellent: product centralization, ease of access, excellent visualization, effective administration changes and management, important updates. In addition to exceptional support

Zunilda G. Project and Innovation Specialist -

We implemented the self-management strategy for bank clients to easily access information and transactions. The integration was simple through parameterization and API integration

Edna Mabel R. Channels Director -

The agility in integration and implementation is remarkable. The SaaS platform facilitates the operation. From the beginning, the tool offers numerous options that allow offering online services competitively

Luis L. VP Digital Transformation & Technology -

The product is highly appreciated by our clients, as it allows them to self-manage in the most used transactions. It stands out for its potential, with a very reasonable cost-benefit ratio

Eric C. Chief of Digital Channels -

My experience is very good; I love the 'bank at hand' feature because I can easily see my products. The platform is user-friendly, with a simple registration and usage process

Rafael R. *5 Communication Analyst

We have a way of getting you there

Frequently Asked Questions

Absolutely! Our Fraud Prevention solution boasts a wide array of predefined and customizable rules to ensure robust fraud prevention. These predefined rules cover a broad spectrum of common fraud scenarios and patterns, allowing us to effectively identify and prevent both existing and emerging threats. Additionally, our solution allows for variable customization to suit the specific needs of each financial institution. This means you can add extra rules or tweak existing ones as per your requirements and internal policies.

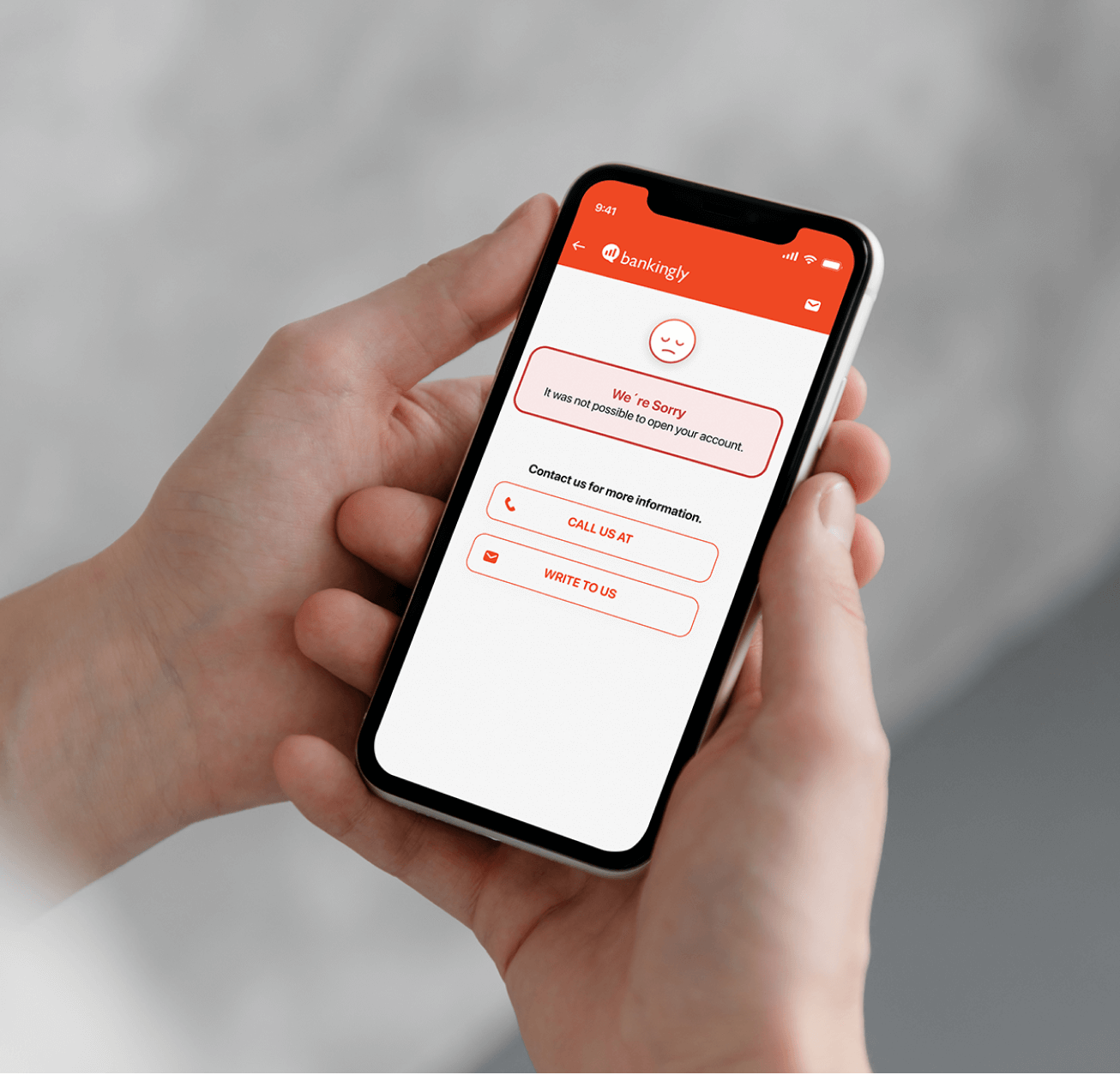

Our Fraud Prevention solution features an administrative portal that provides financial institutions with complete control over fraud prevention activities. From this portal, institutions can view alerts, configure rules, manage cases, generate reports, and much more.

Absolutely! Our fraud prevention solution seamlessly integrates with our web banking and mobile banking solutions, adding an extra layer of security to your digital channels.

Our fraud prevention tool can be configured to provide warnings and also to automatically implement blocks through Machine Learning, which identifies patterns, user behaviors, and transactions to generate actions based on predictive analysis and transactional profiles.

The process for detecting possible frauds is divided into four fundamental steps:

1. Data Collection: A wide range of relevant information is collected, including transaction data, user behavior patterns, historical records, and any other pertinent data.

2. Behavior Analysis: An exhaustive analysis of the collected data is performed to identify normal and abnormal behavior patterns. This involves using advanced algorithms and analysis techniques to examine user activity and transactions for any unusual or suspicious behavior.

3. Anomaly Detection: Based on the previous analysis, potential anomalies that could indicate fraudulent activities are detected and flagged. These anomalies may include unusual transactions, atypical behavior patterns, or any other signs of fraudulent activity.

4. Continuous Improvement: Constant improvements are made to the fraud detection process to adapt to new trends and methods used by criminals. This involves regularly updating algorithms, incorporating new data sources, and constantly reviewing results to ensure effective and accurate detection of possible frauds.