Back to all solutions

Back to all solutions

Conversational banking

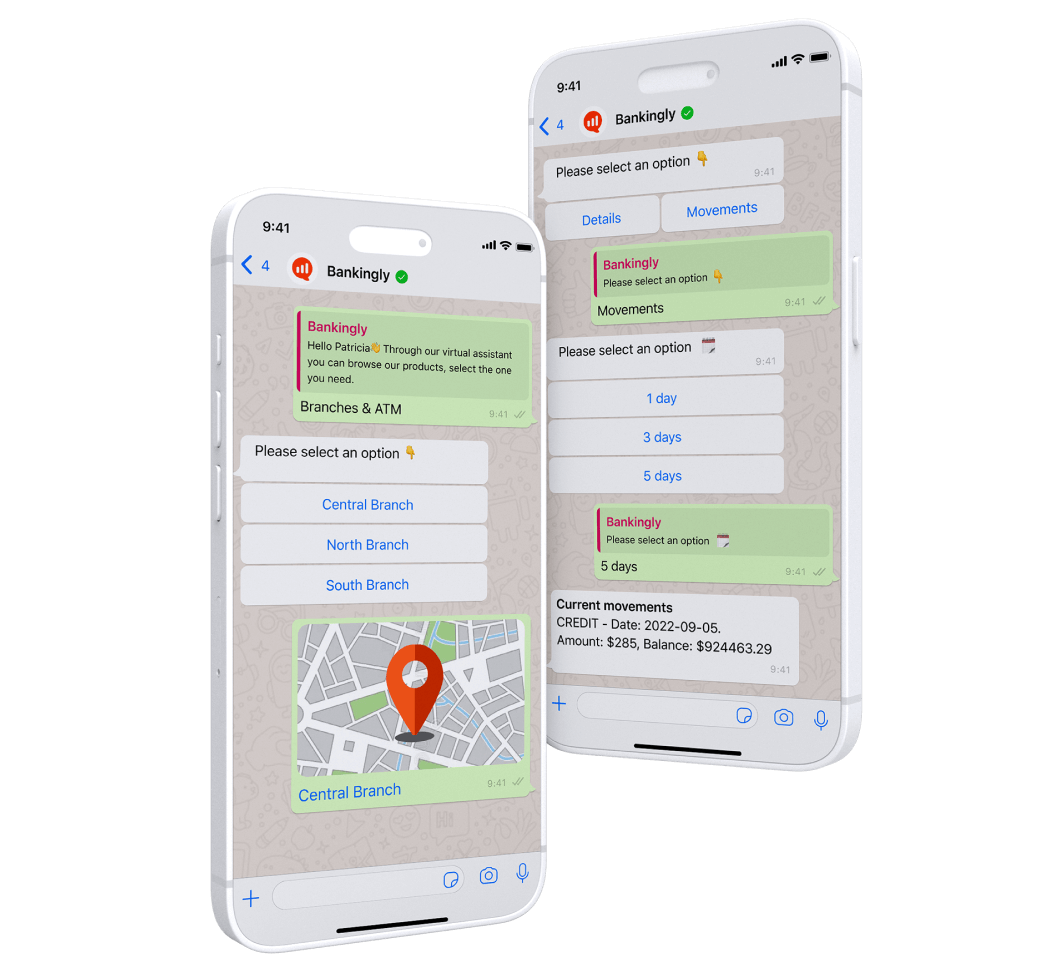

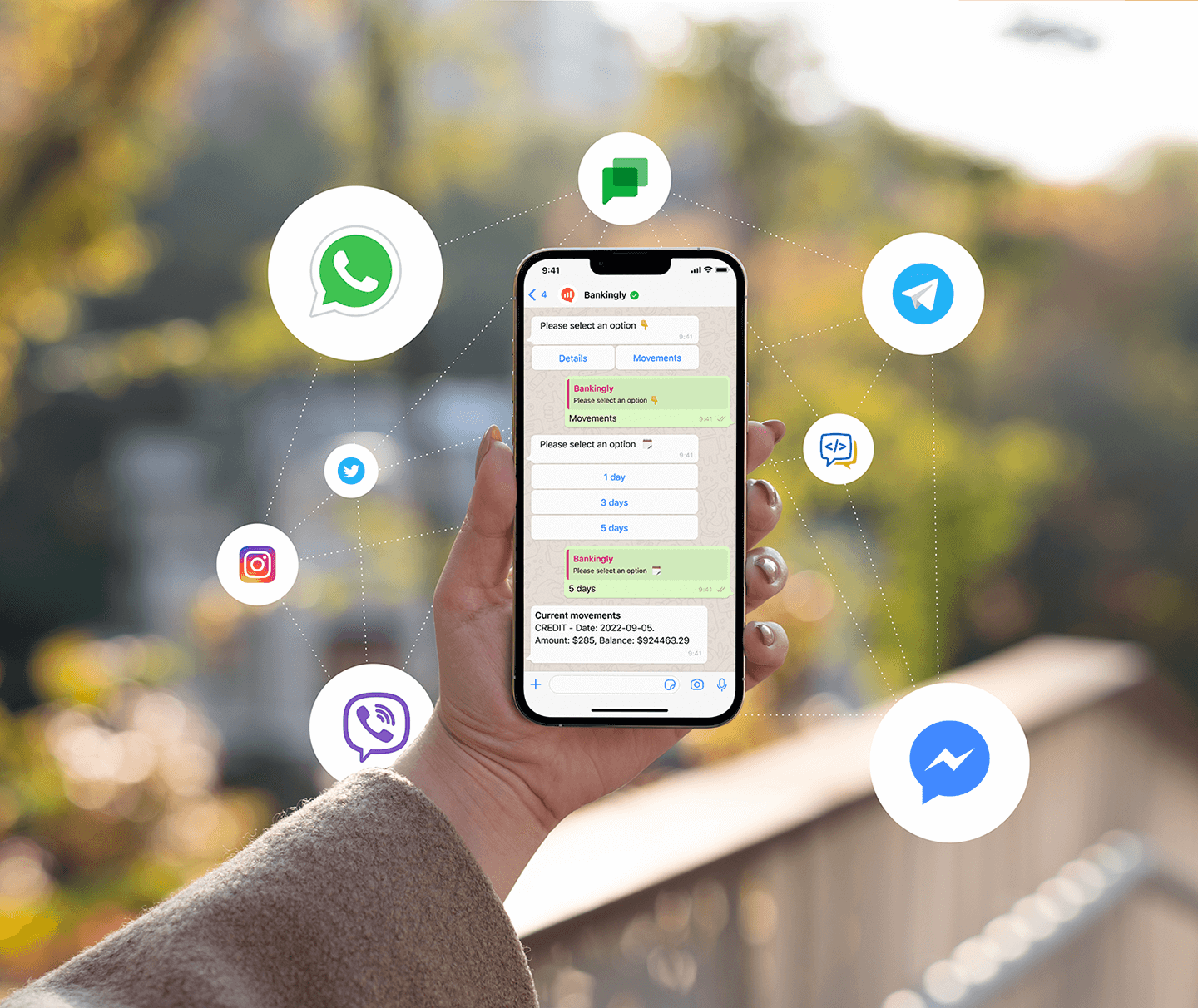

Interactive relationships are key to the user’s experience. The shift to WhatsApp banking should empower that.

Current customers value convenience and choose digital experiences that are fast and easy to use. Connect with your customers on their terms, providing the support they need for a positive experience.

Make conversations flow

Deploy reliable messages and proactively reach consumers wherever they are

Meet the power of conversational banking

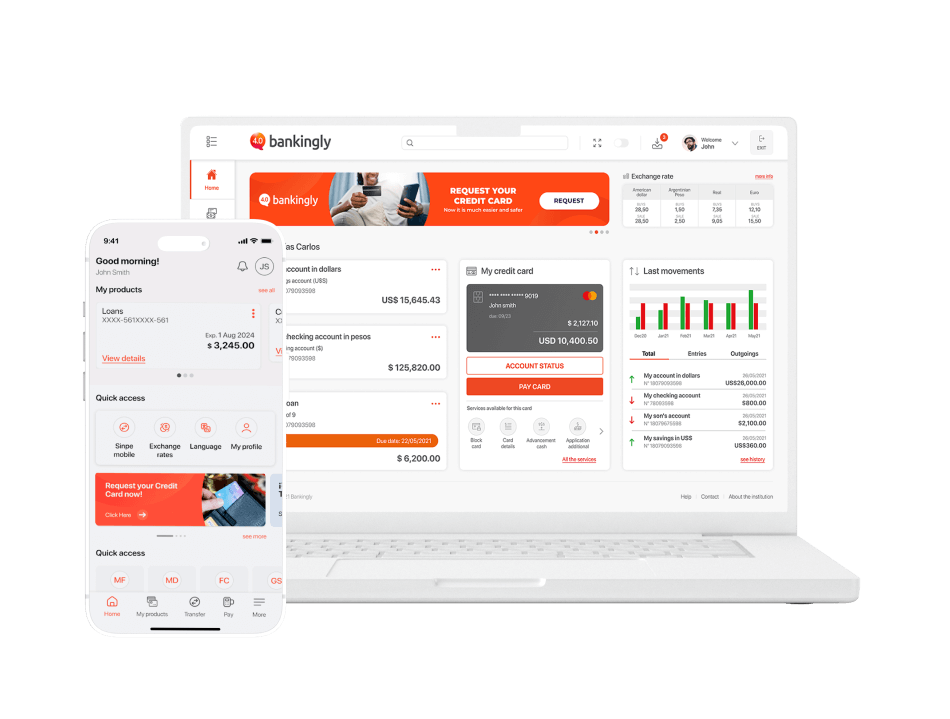

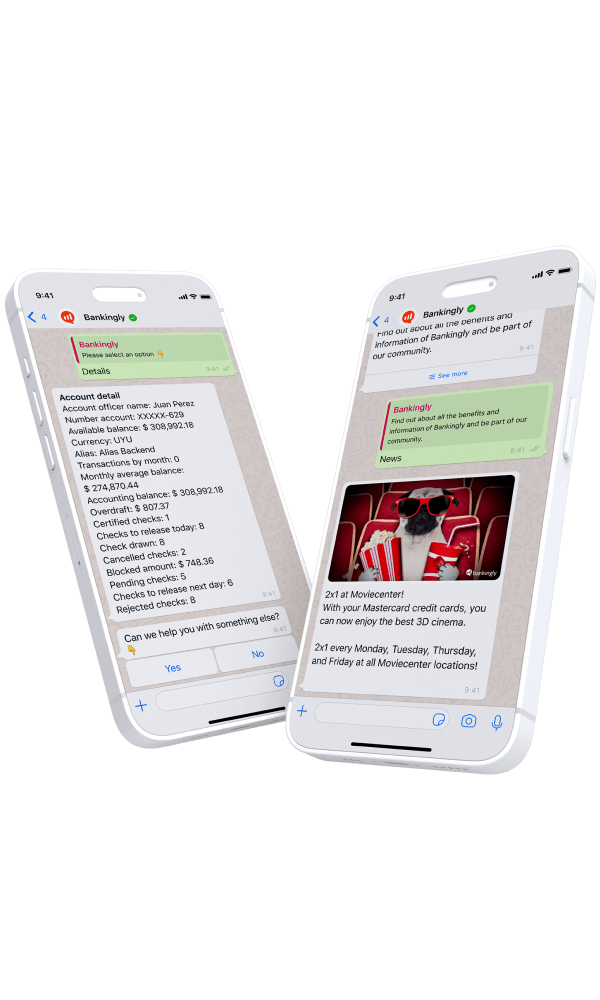

- Digital banking features: account management, real-time transactions, loan and check management, credit cards, service payment, investments, fixed-terms deposit, credit lines.

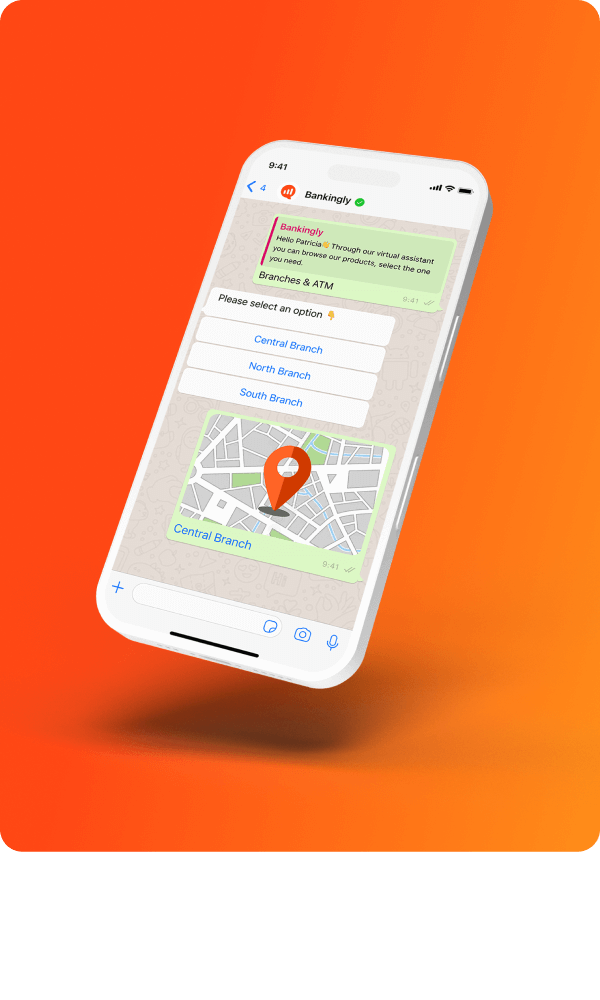

- Offer 24*7 access to discover products on customer's favorite messaging channel like WhatsApp, Facebook Messenger and Viber.

- Leverage security and compliance from most popular channels.

- Considerations for language, tones, uses and customs in communication with customers.

- 100% customizable flow with potential integrations to CRMs, ERPs & other systems.

Boost your debt collection management

Automate the process of reaching out to customers and responding during debt collection, report on outstanding debts and record payment promises.

Basic flows with product details, payment of services, credit cards and transfers.

User-configured transaction notifications for sending and receiving confirmations.

Customer registration with full onboarding (KYC, biometrics, proof of fund, AML check, etc).

Transactional section for paying loan installments or agreements.

Ability to transfer to an agent, either to talk on the phone or to chat.

Process automation: Integration with other systems, such as CRMs, ERPs, or a ticket system.

-

Mobile and Online Banking have been very well received by our partners, leaving us good feedback on the tools we have provided them to manage their accounts

Martín V. Chief Information Security Officer -

A great solution for our partners. We have received the necessary support and more from Bankingly, always maintaining full readiness to support us at any time. Excellent and very professional treatment

Joshue Fernando L. Operations Coordinator -

A great tool: practical, functional, and easy to use in all aspects, both for administration and for the general public

Francisco M. Systems Manager -

The experience is excellent: product centralization, ease of access, excellent visualization, effective administration changes and management, important updates. In addition to exceptional support

Zunilda G. Project and Innovation Specialist -

We implemented the self-management strategy for bank clients to easily access information and transactions. The integration was simple through parameterization and API integration

Edna Mabel R. Channels Director -

The agility in integration and implementation is remarkable. The SaaS platform facilitates the operation. From the beginning, the tool offers numerous options that allow offering online services competitively

Luis L. VP Digital Transformation & Technology -

The product is highly appreciated by our clients, as it allows them to self-manage in the most used transactions. It stands out for its potential, with a very reasonable cost-benefit ratio

Eric C. Chief of Digital Channels -

My experience is very good; I love the 'bank at hand' feature because I can easily see my products. The platform is user-friendly, with a simple registration and usage process

Rafael R. Communication Analyst

We have a way of getting you there

Frequently Asked Questions

Yes, transacting through Bankingly's Chatbot is completely safe. We implement robust security measures to protect users' confidential information and ensure the integrity of transactions. We use encryption technologies and secure communication to protect the transmission of sensitive data.

Yes! At Bankingly, we offer 100% customizable conversation flows to adapt to the specific needs and demands of each financial institution. This includes customization of language, tone, usage, and customs to provide a consistent experience aligned with the institution's identity. Additionally, we can integrate with other client systems such as CRMs, ERPs, or ticketing systems, allowing data retrieval and triggering actions in those systems based on chat interactions.

Absolutely! Bankingly's Chatbot integration is quick and simple based on secure APIs. Our platform is designed to facilitate the implementation process and ensure seamless integration into the financial institution's banking system.

Yes, we offer a basic flow for rapid implementation that allows you to start using our Chatbot quickly and efficiently. This basic flow includes essential functionalities such as branch inquiries, ATM locations, Benefits, News, Contact, and FAQs.

Yes! The end user will be able to access the conversation again through the messaging platform itself, whether it's WhatsApp, Telegram, Facebook Messenger, among others. As for the financial institution, it will also be able to access the conversations and use them to improve the customer experience.