Bankingly is for

financial institutions

banks

credit unions

new alliances

you

Enabling

financial inclusion

Deliver world class digital financial solutions, that enable seamless experiences for:

- digital onboarding

- QR transactions

- identity validation

- business banking services

- conversational banking

- fraud prevention

- mobile banking

- SaaS solutions

- cross selling opportunities

- digital onboarding

- online loan applications

- conversational banking

- business banking

- improve debt collection rates

- key banking features

OUR SOLUTIONS

-

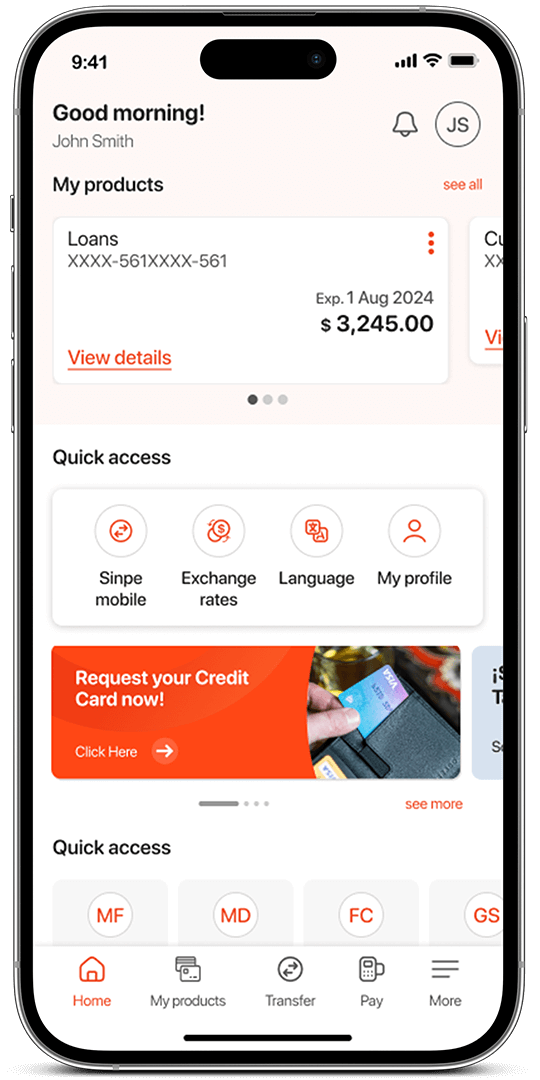

Internet Banking

Boost clients' finances with our modern app offering innovative features and customizable design. Elevate your banking experience today.

-

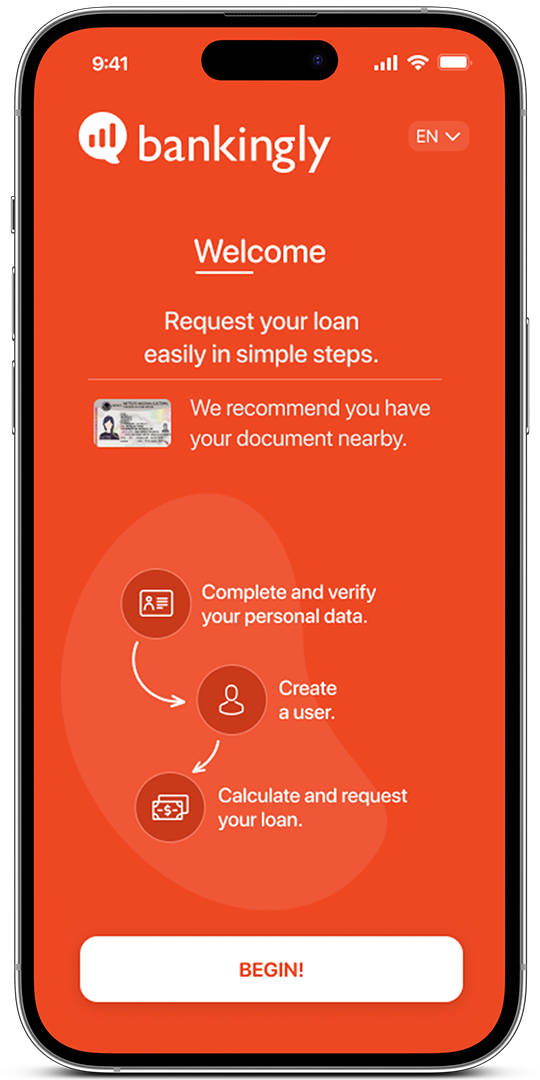

Digital Onboarding

Streamline customer interactions. Apply for financial products efficiently and securely with advanced biometric verification.

-

Conversational Banking

Improve engagement and customer satisfaction through more assertive, personalized and real-time communication on social networks.

-

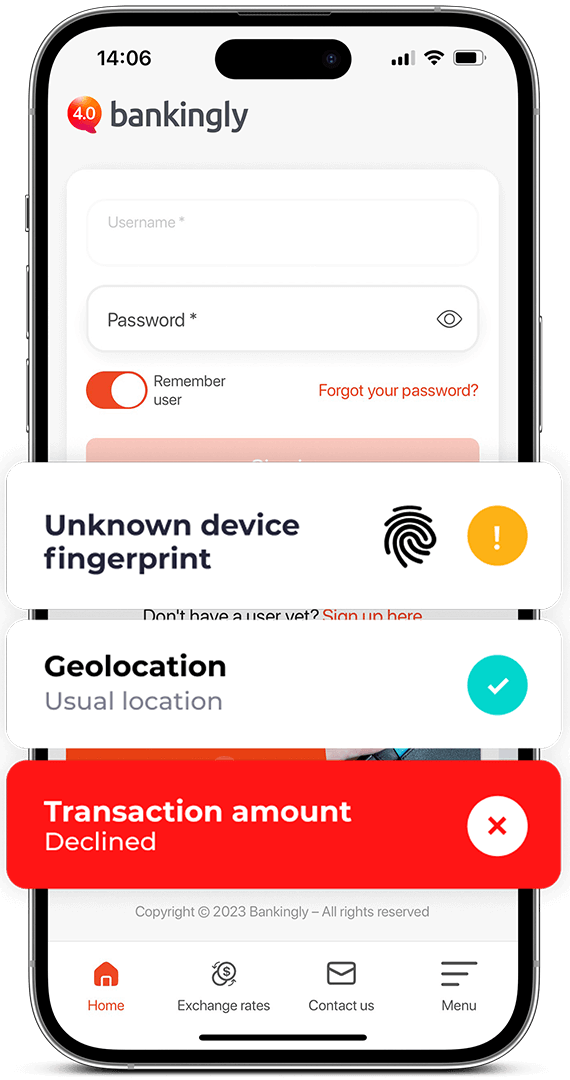

Fraud Prevention

Reduce risk through real-time triggering actions with biometric, user scoring and workflow-based security.

Stay updated

Want to stay at the forefront of the latest trends in your industry? Find up-to-date information on new releases, strategic alliances, expert analysis, and much more.

Testimonials

ABC Bank

KenyaABC Bank in Kenya, stands out as an innovator in digital transformation. The introduction of ABConnect—an omni-channel platform offering services through mobile applications and internet banking developed by Bankingly—underscores the bank's commitment to delivering cutting-edge solutions to its clientele.

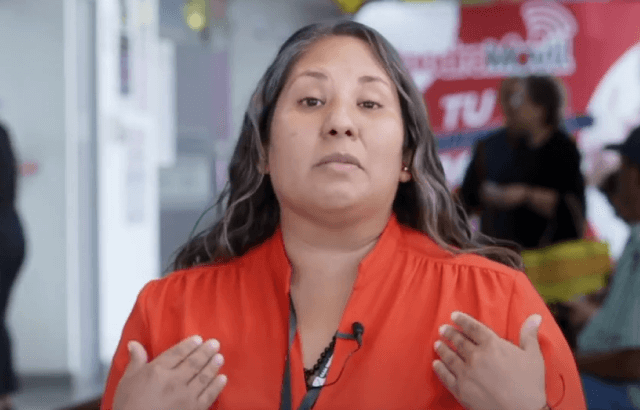

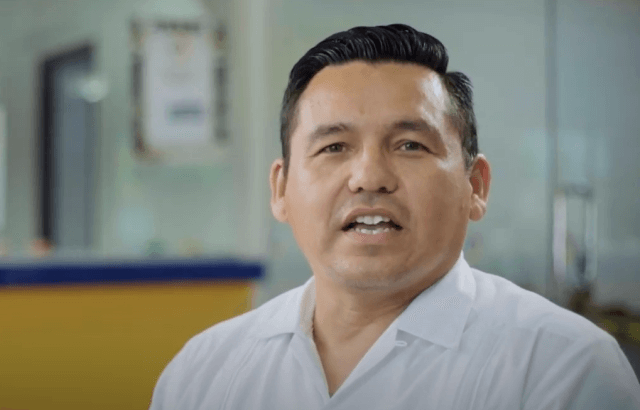

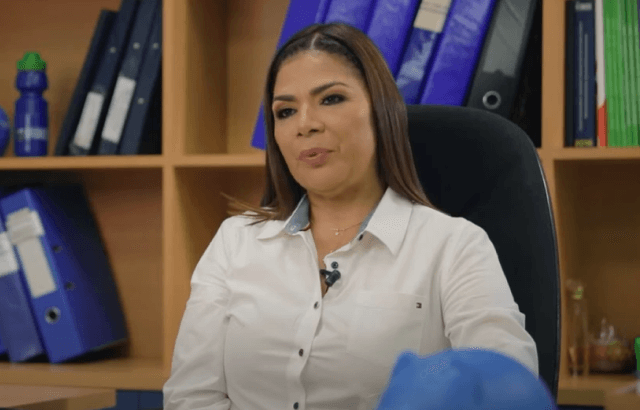

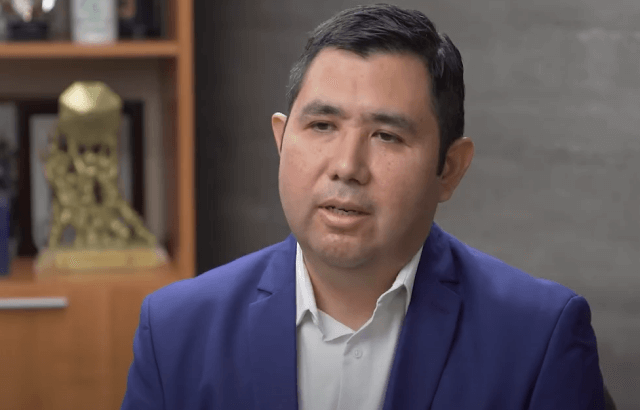

Clients Testimonials

we are +20